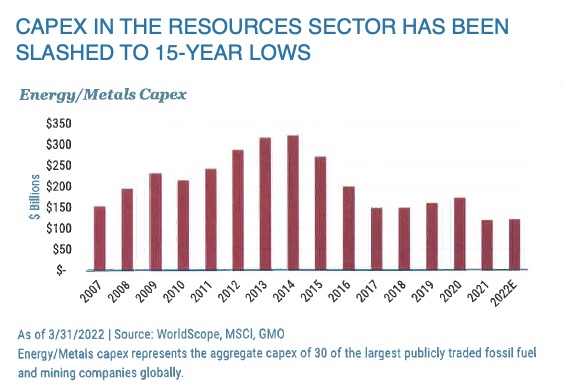

Capital expenditure by large oil and mining companies is down to a 15-year low despite a 40% rise in global commodity consumption over the same period, according to a new report.

Investment firm GMO in its quarterly publication takes a look at how investors can protect themselves from inflation by investing in natural resource stocks, which, according to the report, remain fundamentally undervalued.

Lucas White, portfolio manager for Resources and Climate Change Strategies at the Boston-based company, says it is “somewhat stunning” that despite the fact that the world consumes around 40% more of many major commodities like natural gas, iron ore and copper than it did 15 years ago, resource companies have slashed investment in new production.

White points out that the Bloomberg commodity index is up 500% since 2000, adding that “it’s hard to imagine any plausible explanation for such a dramatic surge in commodity prices that doesn’t include a healthy dose of scarcity”:

“Underinvestment in supply in recent years will impact production for at least the next decade. Over most of the last decade, commodity prices have been falling or low. Commodity producers, reacting to low prices and criticism that they had overinvested during the China-driven commodity supercycle, slashed capex significantly.

“Pressure from ESG/sustainability circles and divestment campaigns also sought to starve fossil fuel companies of capital.

“Then, covid hit, and resource companies cut capex again. Furthermore, the capital intensity of commodity production has also risen substantially in recent decades as we’ve moved from higher- to lower-quality assets.

“In short, current capex levels are totally insufficient if we are to meet growing global demand.”